sales tax on leased cars in maryland

In Maryland it will always be at 6. The good news for Maryland residents is that sales tax is not collected at the city or county level.

Used Car Prices Have Surged How To Make That Work To Your Advantage

Sales tax on Maryland leased vehicle.

. For instance an 11½ percent tax is imposed on short. To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county. On average 575 applies as a car trade-in services in Maryland while.

If a lien is placed against your title a Maryland Security Interest Filing SIF will be mailed to the lien holder at the same time. Yes you pay sales tax on the full purchase price in MD before any rebates in your case 2520 tax on a 42k sale but at the. To calculate the trade-in tax credit in Maryland you can get the idea from the percentage of trade-in tax credit against your new cars purchase.

Ad Find Car Leases Online Low Prices. Ad Get Maryland Tax Rate By Zip. An excise tax will be charged on the basis of 6 of the vehicles book value or 6 of the purchase price on the notarized Bill of Sale for vehicles 7 years old or newer.

In Maryland does the dealer charge sales tax on the entire price of the vehicle when leased same as if it was purchased. In these special situations there may be a special tax rate charged rather than the six 6 percent sales and use tax rate. On average 575 applies as.

Pick Local Dealers Find Secret Specials. This page describes the taxability of. Free Unlimited Searches Try Now.

Rocktimberwolf December 21 2015 252am 1. Vehicles leased by the State or local government agencies are exempt from paying the excise tax. State sales taxes apply to purchases made in Maryland while the use tax refers to the tax on goods purchased out of state.

In many cases the vehicle is exempt from any excise tax provided. Ask the Hackrs. And I am being told that.

Save up to 30 with Secret Lease Offers. Businesses in Maryland are required to collect. It is a huge pain - but there is a tarnished silver lining.

Certain short-term truck rentals are subject to an eight 8 percent tax. Just about every car purchase is subject to additional fees. While Marylands sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

One of these fees is. The best way to calculate the amount of sales tax on your lease buyout is to look at the original lease paperwork where you can find a breakdown of the taxes. Request a Lease Quote on Any Car.

Typically the title application documents needed along with payment for taxes and fees. Multiply the vehicle price before any trade-ins andor. Hey Hackers I am considering leasing a vehicle instead of buying it for the 1st time.

Leasing A Car And Moving To Another State What To Know And What To Do

Car Sales Tax In Delaware Getjerry Com

Used Cars For Sale In Baltimore Md Koons White Marsh Chevrolet Used Car Dealership

Florida Sales Tax For Nonresident Car Purchases 2020

Are Car Repairs Tax Deductible H R Block

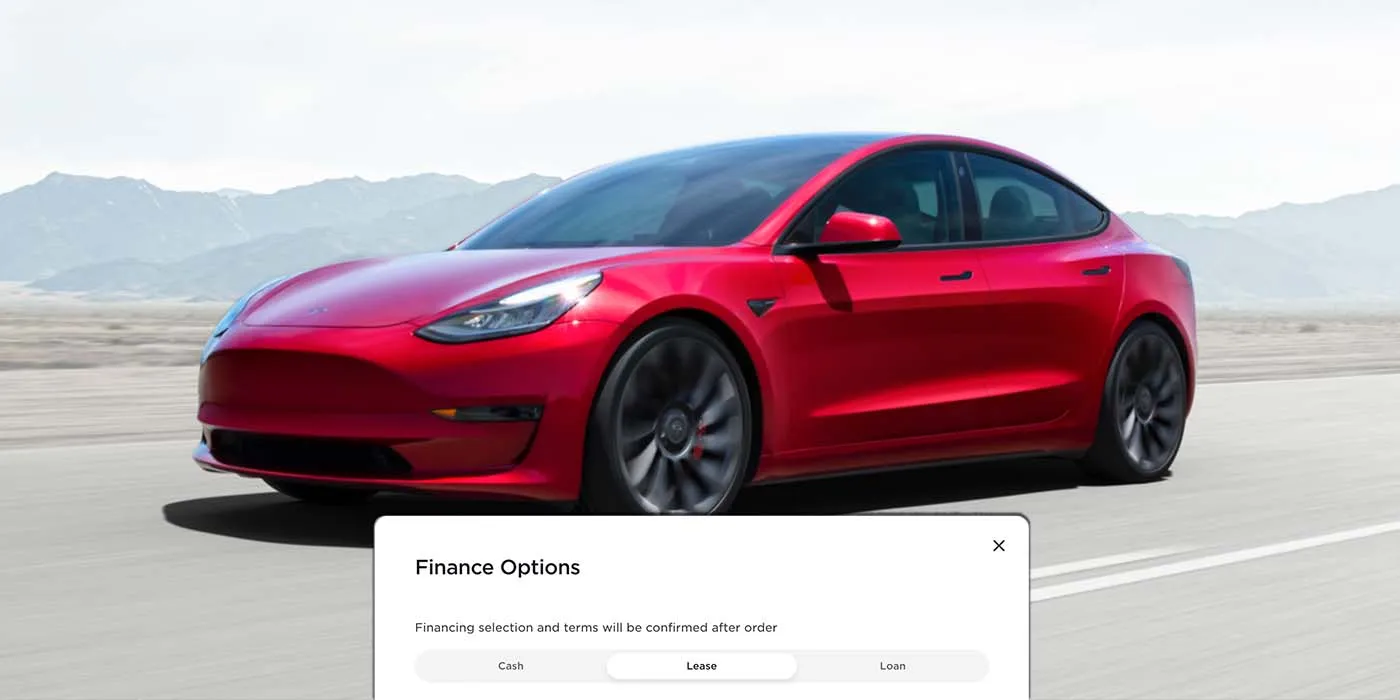

How Much Is A Tesla Lease In 2022 Electrek

Jeep 4xe Hybrid Tax Credits Incentives By State

New Honda Cars Suvs Vans For Sale In Baltimore Md Norris Honda

Maryland Sales Use Tax Guide Avalara

Used Cars For Sale In Baltimore Md Cars Com

Used Cars For Sale In Baltimore Md Koons White Marsh Chevrolet Used Car Dealership

![]()

Sales Tax On Lease Transfer Question Md Va Car Forums At Edmunds Com

Maryland Car Tax Everything You Need To Know

Baltimore Chevrolet Dealer Bob Bell Chevrolet New Chevrolet Used Cars

How To Start A Car Rental Business Truic

Illinois Imposing Car Trade In Tax On Jan 1 Dealers Call It Double Taxation